(NASDAQ:ECYT)

Quick Take

- ECYT CEO Ron Ellis Exercised options to purchase 80,000 shares on March 10th

- Options had expiry dates in 2016

- We view this early exercise as a bullish sign given upcoming milestones for ECYT

A Bullish Options Exercise

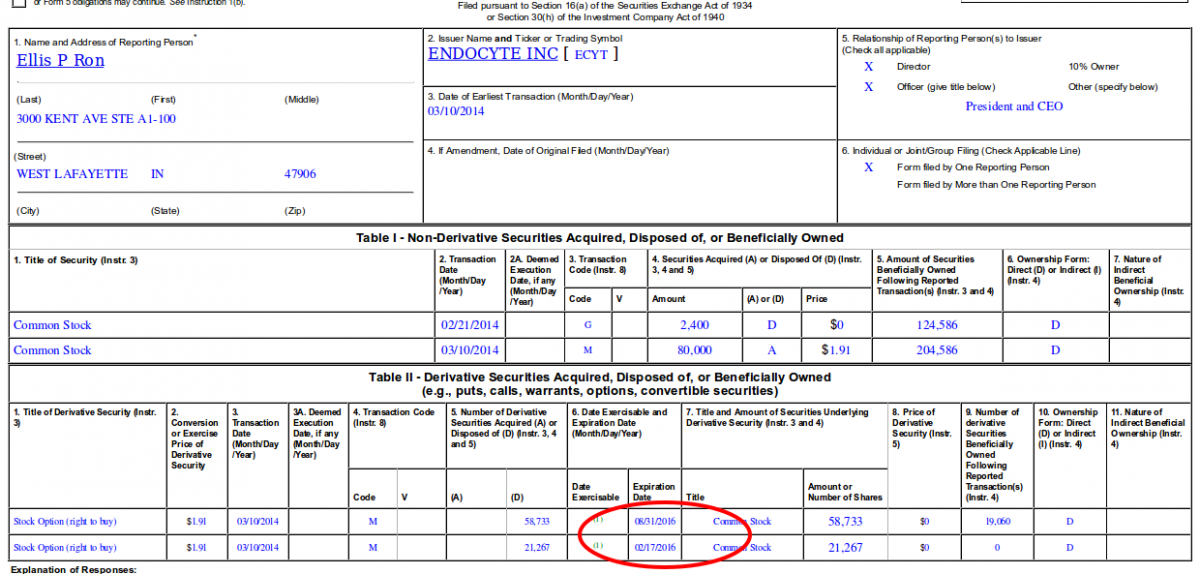

On March 12th ECYT disclosed in an SEC filing that CEO Ron Ellis exercised stock options to purchase 80,000 shares of company stock at a price of $1.91. As seen below, the exercised options had expiry dates in February and August of 2016. (see circled dates in image below - click to enlarge):

This is a highly bullish move ahead of two key events for the company this month as outlined below.

Two Key Events This Month

Phase 2 data from TARGET Trial

First, ECYT and partner Merck (NYSE:MRK) are expected to report top-line results from their phase 2 TARGET trial of vintafolide in non-small cell lung cancer. Based on an interim look at the data, the independent data monitoring committee indicated that the vintafolide monotherapy arm was not likely to outperform the docetaxel arm; however, the monotherapy arm was not stopped completely. Investors will be watching to see whether or not the combination of vintafolide and docetaxel will out-perform docetaxel alone in this trial. If the combination therapy demonstrates an overall survival advantage for this folate receptor positive patient population, this would be a win for the company.

Conditional Approval Decision in Europe

The second major event for ECYT is an official opinion from the European Union's Committee for Medicinal Products for Human use (CHMP) on conditional approval for vintafolide in platinum resistant ovarian cancer. The CHMP meets from March 17th to 20th and the meeting highlights will be available here on Friday March 21st around 7:30 am eastern-time.

Recall that last month, Endocyte went before the CHMP for an oral explanation related to the day 180 List of Outstanding Issues for their Vintafolide conditional marketing application. The way the EU procedure works, when a company appears for an oral explanation, a straw-vote of the CHMP members is taken regarding which way the trend of the decision is likely to go. While this trend is NOT binding and CHMP members are free to change their mind before the final vote at the next monthly meeting, it is important to note that the company IS informed of the trend vote.

Summary

Putting all the pieces together here is the picture that emerges:

1) ECYT is expecting top-line data for TARGET phase 2 - we do not believe that the company has any advanced read-through on the outcome of the trial other than the fact that the vinatfolide arm will not outperform the docetaxel arm.

2) After last month's oral explanation ECYT insiders knew the trend vote from the CHMP. While not binding, this trend indicates how this month's official opinion might go.

3) CEO Ron Ellis paid $152,800 to exercise his options nearly 2 years before they were to expire, and just days ahead of two pivotal events for the company.

While only Ron Ellis knows exactly why he made this move ahead of such key data, our view is that, at least for the CHMP decision, he may have some idea of which way the CHMP was leaning after the oral explanation.

We caution readers that the pivotal events for ECYT carry a high degree of uncertainty. Hedged positions are, in our view, the best approach to trading the binary events for ECYT this month. Nevertheless, when a CEO exercises options early, it is an interesting signal.

Note: In connection with ECYT, Red Acre has a hedged long position.