iShares Biotechnology ETF (NASDAQ:IBB)

- IBB has sold off by 17% since it's most recent high

- Strong selling has brought IBB down to the previous trend support

- After end of quarter selling an uptick is possible

Biotech Selloff

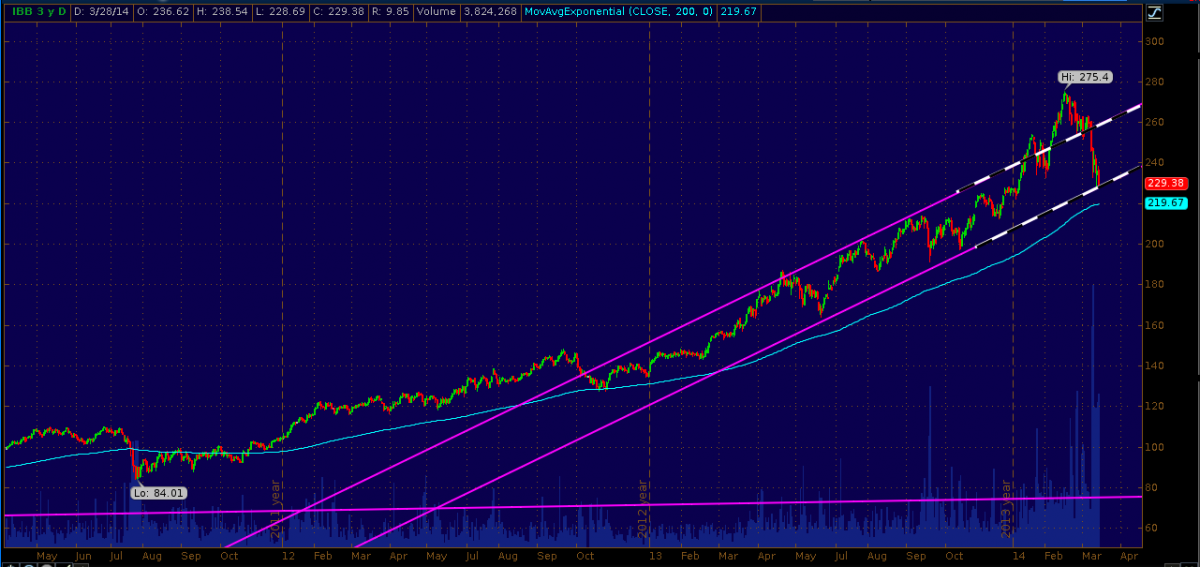

The biotech market has been selling off since late February. The iShares Biotechnology Exchange Traded Fund (IBB) is down approximately 17% from it's late February highs. As seen in the chart below (data from TD Ameritrade - click to enlarge).

Waxman Letter Triggers Selling

The letter sent by congressman Henry Waxman and two of his Democratic colleagues to Gilead was the trigger for the latest round of selling in biotech.

Generalist investment funds that have been pouring money into biotech since last year (see trading channel in the chart) have been spooked by the risk of wider pressure on drug prices as well as the general financial media's constant drumbeat of "biotech bubble". In reality, biotech is a very tiny fraction of the total stock market (all of biotech is less than 3% of the market cap of the S&P 500).

Support Levels

The $230 level is a critical support level to watch for the IBB. This represents the forward extension of the previous support trend. Given that the recent selloff comes at the end of Q1, traders are closely watching for this support level to hold. If this support level holds, traders may be expecting a bounce in the IBB come April 1st when Q2 begins.

On the other hand, if the broad biotech selloff continues, the next support level to watch would be the 200 day Exponential moving average which stands at $219.