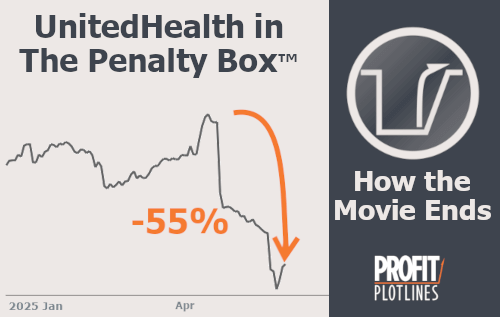

United Health is in the Penalty Box

We've seen the movie before; here's how it ends.

Hint: Look for two key things (explained inside.)

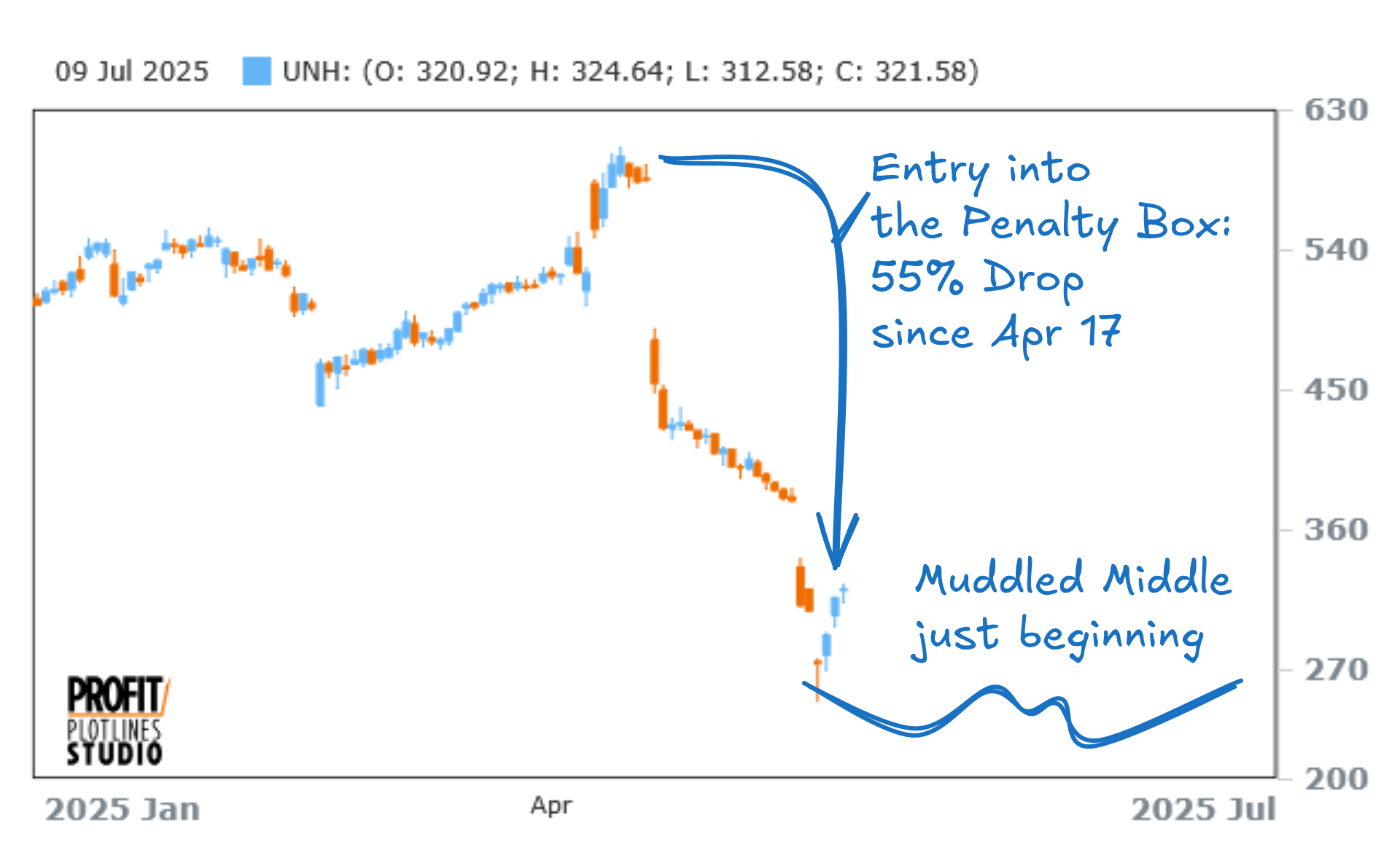

UnitedHealth (NYSE:UNH) has dropped more than 55 % in a month and everybody on X, Reddit, and CNBC is slapping a label on the mess: "falling knife", "value trap", "dead-cat bounce", "dumpster fire". Those words tell you what just happened. They do nothing to tell you what happens next.

Here's a better frame: UNH isn't broken, it isn't dead, it's in The Penalty Box - that's one of 9 situational plotlines that repeat again and again in the markets when companies have news and investors react. That single plotline shows where we are in the story and the two headlines that end the penalty period. Let's walk through the plot.

The Penalty Box - Plot Summary

Stocks of any size sell off and enter the Penalty Box when negative developments temporarily increase uncertainty. If the reason behind the sell off resolves favorably, the penalty ends. Investors buy the stock again, raising the price. The negative event can be company- industry-, or country-specific, or be global.

-Profit Plotlines Ch 7, P 125 Rajesh Patel, PhD

We've seen this movie before

Plotlines help us conceptualize the evolving situation because they repeat-again and again in the markets.

-

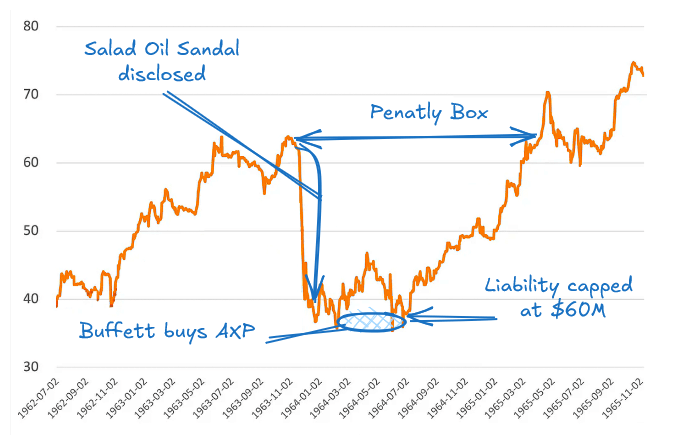

1963-64: American Express (NYSE:AXP). The Salad Oil Scandal knocks shares in half. This is one of Warren Buffett's most famous trades. Recognizing that AXP was in the Penalty Box, Buffett put close to 20% of his partnership capital in the stock in early 1964. Just a few months later, in July, investors took the stock out of the Penalty Box when the liability for the scandal was capped at $60 million.

-

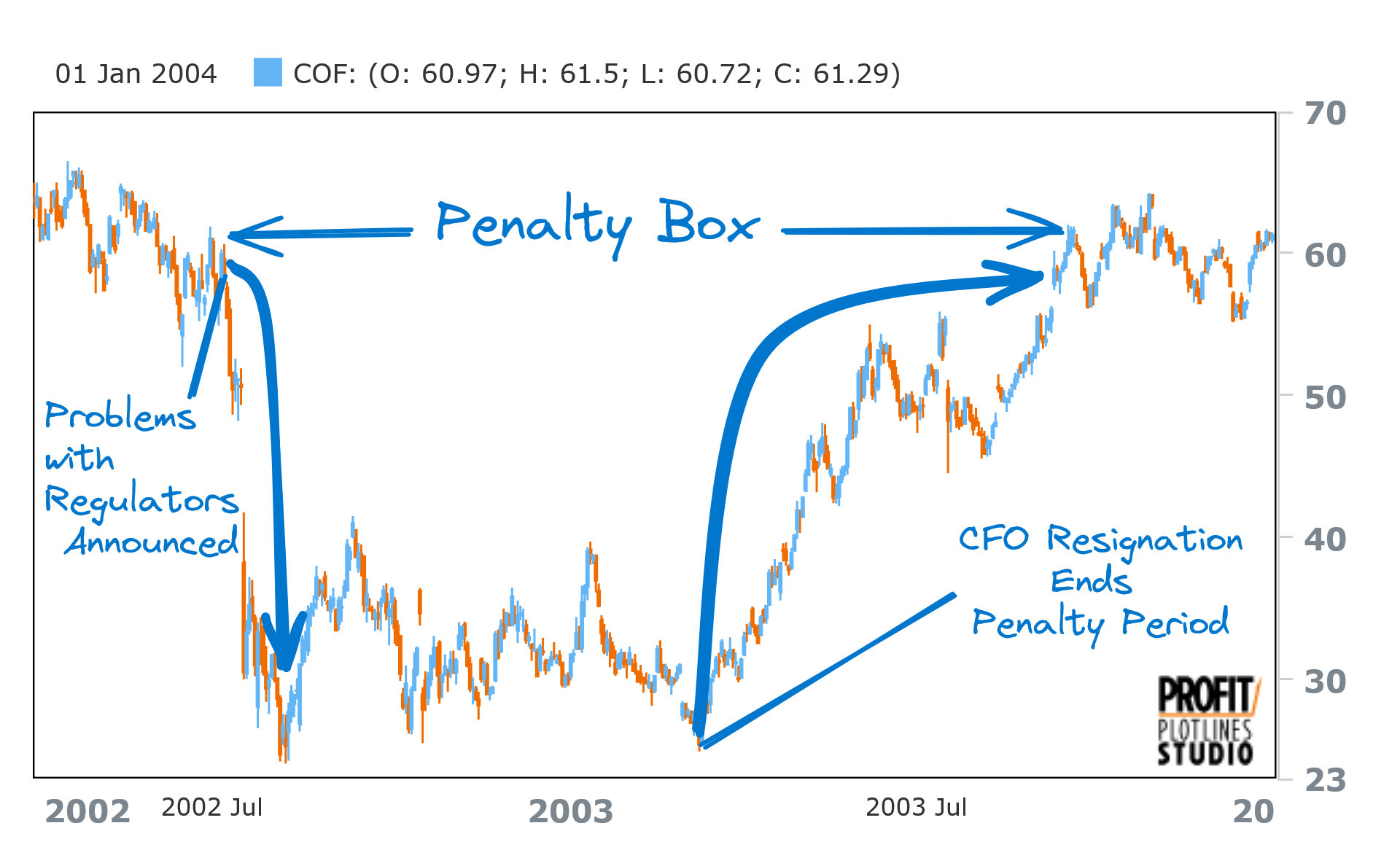

2002-2003 Capital One Financial (NYSE:COF). Regulators questioned capital reserves and first communicated this to the company CFO. Instead of informing the company, the CFO sold personal shares. Two months later when the company reported the possible capital reserve issue, investors saw the CFO's sales and put Capital One into the Penalty Box. The stock went from $60 to $30 in two days. Months later, in early 2003, Cornwall Capital Management put 25% of their funds' capital into $40 LEAPS.

When the CFO stepped down to deal with the SEC's Wells notice related to his insider trading, investors took this as the all-clear and Capital One rallied back to the $60 level in a few months. Cornwall's $26K investment grew to over $500K by catching the move out of the Penalty Box. (Michael Lewis wrote about Cornwall's trade in The Big Short. I detail the Penalty Box aspects in chapter 7 of my own book: Profit Plotlines)

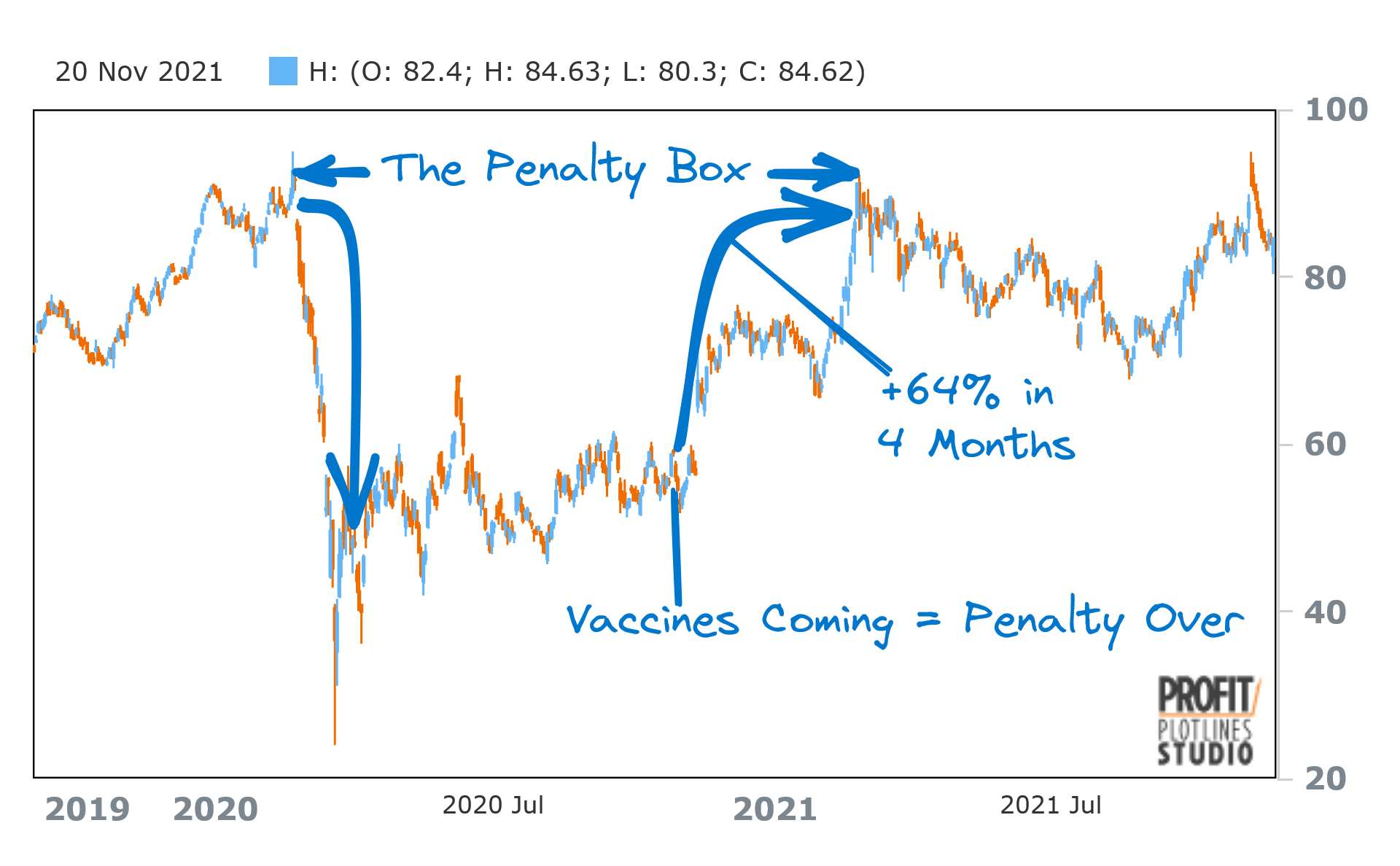

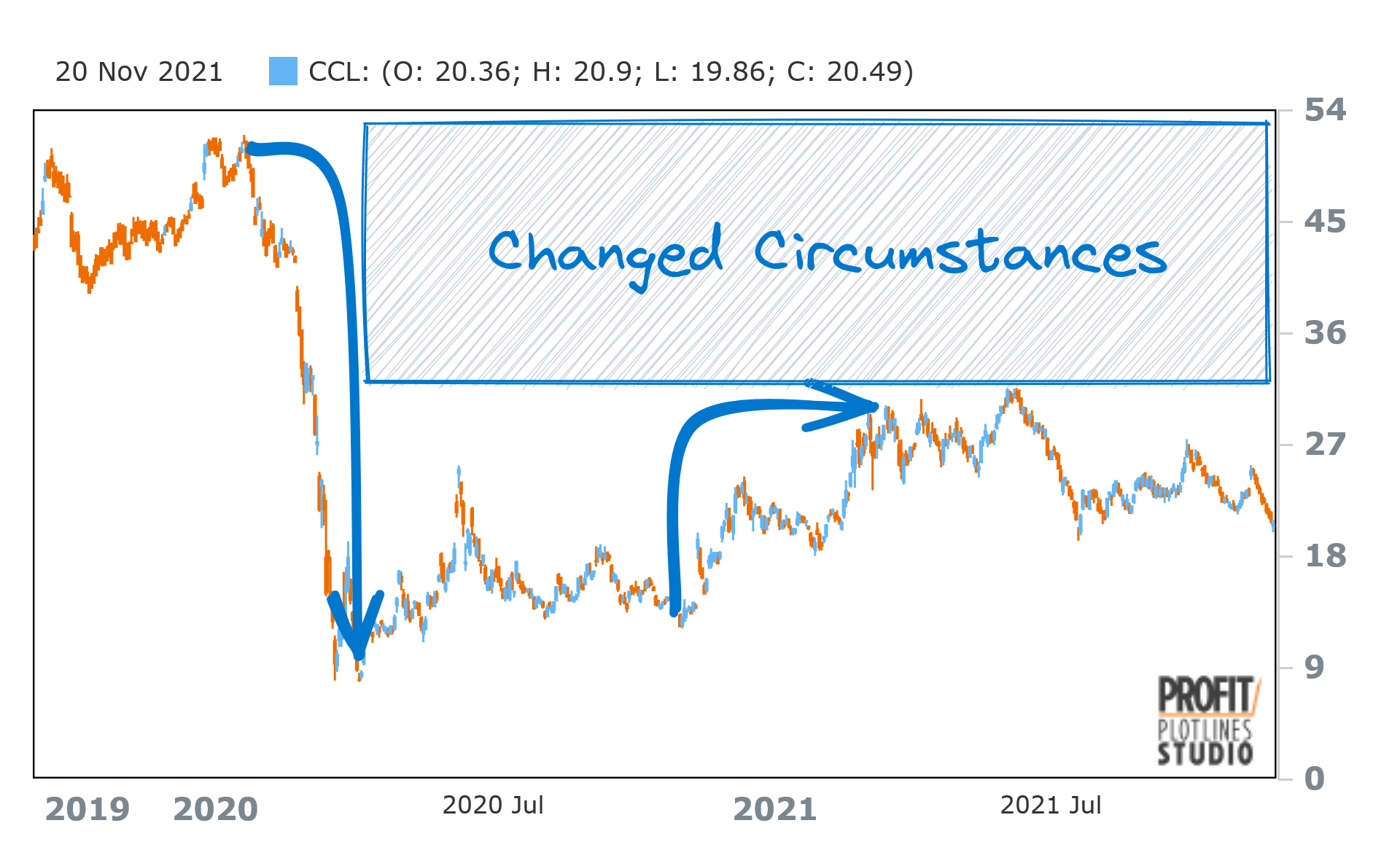

- 2020-21 Travel Stocks. March COVID lockdowns cratered the entire travel sector affecting hotels, resorts, cruise lines and more. These stocks started to rally in Late October in advance of the expected phase 3 efficacy results for COVID vaccines from Pfizer(PFE), BioNtec (BNTX), and Moderna (MRNA). Over the next 6 months travel stocks rallied hard. Hyatt hotels (NYSE:H) gained 64%, Playa hotels and resorts (NASDAQ:PLYA) gained 86% and even cruise lines gained more than 55%.

Same Plotline, three different decades-see how this works?

How the Penalty Box is playing out for UnitedHealth

Act I: The Fall from Grace

The fall from grace happened in 3 quick steps:

- 17 Apr: first earnings miss since 2008 + guidance revised down -28 %.

- 13 May: CEO Andrew Witty replaced, forward guidance pulled -18 %.

- 14 May: WSJ story DOJ possible criminal probe into potential Medicare Advantage fraud: another -16 %.

That's the end of Act I. UNH is down 50+% from it's peak, and class action lawsuits abound.

Act II The Muddled Middle (Mid-May 2025 we are here)

No guidance, no legal liability figure, and every analyst was forced to slash price targets. Media sites all echoed the same anonymous DOJ rumor creating a negative feedback loop. Markets hate uncertainty and the muddled middle will go on until clarity shows up.

n.b. We reached out to Wall Street Journal reporters and to UNH regarding the timing of the article and when/whether UNH had a head's up. We received a "we can't comment beyond what we reported" from the WSJ. UNH did not return our inquiry into the timing issue. This timing issue is sure to come up in future class action litigation surrounding the Andrew Witty departure and the journal article the next day which compounded investor losses.

Act III: The Redemption (future)

We believe two headlines start Act III

- Management reinstates guidance The potential losses due to higher than expected Medicare utilization can be factored in and analysts can estimate forward earnings again. There will be an eventual re-rating of price targets back to >$400 (but see the potential plot twist below.)

- The company puts real numbers around the DOJ risk (if any) a settlement, a fine, anything with a dollar sign. This lets investors anticipate any legal/regulatory tail risk.

History says that these two clearing events are when serious money comes off the sideline and the chart starts to look like a redemption arc, not a murder mystery.

Broken franchise is the potential plot twist

The Penalty Box only works if the basic franchise survives. Buffett noticed diners were still using their AmEx cards despite the salad oil scandal. Hyatt bounced because travel was on pause but the need never went away. In contrast, cruise lines (NYSE:CCL) didn't bounce back as much because passengers stayed nervous for several years.

Right now, the worst case scenario driving investor fear is: The DOJ investigation is real, has teeth, and finds real criminal liability. The company is forced into a consent decree or worse, barred from Medicare Advantage altogether. This would blow a 30+% hole in UNH's revenue.

Based on currently available information, we believe this scenario is extremely unlikely. While UNH's practices may be aggressive, it would be difficult to prove an intention to defraud the government. Maximizing profits within the letter of the law is not illegal even if it is unpopular.

The more likely scenario is that, if it ever gets to legal action, in order to move past any potential litigation, UNH settles with the DOJ. The sum could be in the hundreds of millions (Cigna recently settled a separate medicare related issue for $172 million.) Even a low single digit billion settlement is painful but survivable.

To be clear: we don't mean to pre-suppose innocence or guilt here--that's not the point. The point is to understand how investor psychology evolves--and what the gating factors for a major recovery are based on the plotline.Summing Up

We believe UNH is following the Penalty Box Profit Plotline to a Tee. Act III-the redemption-starts when the market gets clarity on forward guidance and on legal liability. Look to the Mid-July Q2 earnings call for potential clarity on forward guidance.

In the meantime, investors will react to any further news on the DOJ front. If the department brings charges, expect another leg down. Deeper into the box we go. But once the liability is capped, or, the investigation is vacated, the recovery begins. Just like with AXP in 1964, Capital One in 2003 and travel stocks in 2020, the majority of investors prefer to be on the sidelines when uncertainty is high.

By understanding the story beats of the Penalty Box, we can filter the noise, and buy just ahead of the recovery without risking months of "dead money" while the muddled middle plays out.

Your Situational Playbook

The Penalty Box is just one of 9 Profit Plotlines that repeat again and again when companies have news and investors react. Investing is situational. Trades are stories. Plotlines thinking lets us tap into a situational lens. It helps organize all the headlines, opinions, and price action, into well known story beats that keep repeating in the markets.

For a free situational investing playbook to all 9 profit plotlines please visit this link.

Get The Playbook