From the Onyx takeover news and associated uptick in other mid-cap bios to financings by MannKind Corporation and Sarepta Therapeutics to trial news from Achillion, Coranado, Threshold and Insmed, to partnership news from Avanir, and the proxy fight for VVUS being taken to the next level, the third quarter has started off with a shortened but phenomenally busy week in binary events.

Onyx Pharmaceuticals (NASDAQ:ONXX)

We expect ONXX to trade well above $120 on Monday. Furthermore, other mid-cap biotechs with promising pipelines may also see an uptick as the market anticipates that unsuccessful bidders for ONYX may look for other companies to buy.

Mannkind Corporation (NASDAQ:MNKD)

Quick Take:Mannkind announced toady a $160 debt financing deal with Deerfield. The financing comes in 4 tranches and is at 9.75% and has conversion provisions for up to $40 million of stock.

Details:

This debt deal provides $40 million at: closing, when top-line results are announced, when MNKD pays back the 3.75% senior convertible notes, and when Afrezza is FDA approved.

A portion of the debt is convertible, at Deerfield's option, for a set period after top-line results are out. If MNKD's stock price is above $6.67, up to 6 million shares could be issued as part of the conversion, if the stock rice is below $3.33 no more than 12 million shares would be issued, and if the stock price is between these values, no more that $40 million worth of debt can be converted.

These are not the best terms for a financing. The fact that The Mann Group is not participating side by side in this deal is also a slight negative since Al Mann has participated in every other offering in the past 3 years.

We covered MNKD's capital structure in our weekly review for the week ending June 20th wherein we suggested that a financing would have to happen either in late August or to mid-September. Apparently MNKD management felt the same way, but in our view, this deal, while giving the company some breathing room, does not remove all of the financing risk since the Mann Group's credit line is still due in January 2014. (Most likely this line will be converted to equity if the trial data are positive.)

We'll have more to say about MNKD in an upcoming Red Acre Insight in the coming week or so, As a subscriber on our list you will have access to this analysis ahead of the general public.

We are long MNKD. As We've indicated in past weekly reviews, we've scaled out of the bulk of our MNKD position.

Avanir Pharmaceuticals (NASDAQ:AVNR)

Sticking with the breath powered drug delivery theme, AVNR reported on July 2nd that the company has in-licensed a inhalable migraine therapy developed by OptiNose. The deal includes a $20 million up-front payment as well as up to $90 million in additional milestones plus tiered royalties on North American sales. Aside from looking ridiculous sticking a device up your nose and then blowing the medicine into the nasal cavity, we believe that taking on additional debt to fund the upfront payment was not the best move. Prior to the deal announcement, AVNR had around $67 in cash (as of 3/31) and $30 million in total debt. As part of the deal, the company plans to take on $50 million in new debt, the proceeds of which will be used to 1) repay the existing $30 million outstanding debt, and 2) fund the up-front milestone payment. Thus the company's cash t debt ratio will go from 2.23 to 1.34. This will be followed by additional regulatory milestone payments (which are currently unspecified)

AVNR gets an inhaled formulation of a generic drug (sumatriptan) that is ready for NDA submission, and presumably, by Q1 2015, they may have a regulatory decision. Meanwhile, Allergan (NYSE:AGN) has an inhaled levadex formulation which recently received a CRL but may be on the market by the time AVNR's drug sees approval, and NuPathe (NASDAQ:PATH) has their sumatriptan skin patch which alleviated the same nausea problems. All in all it seems like a very competitive landscape where the company will have to spend considerable resources to compete effectively.

We have no position in Avanir.

Sarepta Therapeutics (NASDAQ:SRPT)

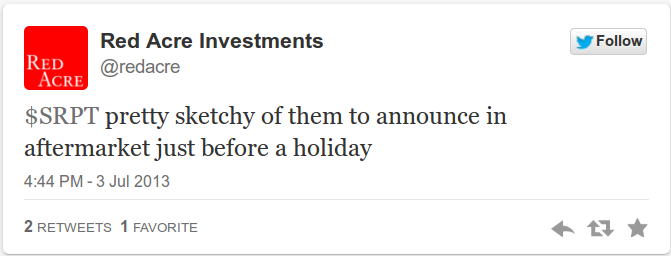

On July 3rd, which was a shortened trading day ahead of the markets being closed on Independence day, SPRT announced a $125 million At-the-market financing facility well after the market had closed for trading. In response we tweeted our view that:

This tweet generated some responses/questions along the lines of:

SRPT clearly will need the funds to conduct their phase 3 trial of eteplirsen. As is well known to our readers by now, we're not huge fans of ATM facilities at Red Acre because once the initial document is filed, the company is potentially selling into every rally in the stock, and there is very little disclosure of when the actual selling takes place. We've talked to a few buy siders about the bear thesis of SRPT, but haven't really had the chance to talk to buy siders who are bullish on the stock (they exist, we're just not in touch with them at the moment).

While everyone's immediate focus is the upcoming meeting between SRPT and FDA wherein it is hoped that a decision on whether or not SRPT will file for accelerated approval will be made, the timelines of catalysts for SRPT need to factor in the data events for Prosensa (NASDAQ:RNA) as well. Prosensa's phase 3 data will come out before SRPT files for approval, accelerated or otherwise. Positive data for prosensa is clearly positive for SRPT. Negative data may or may not be relevant for SRPT. If the data show strong safety concerns as some think likely, this may not reflect on SRPT sine the drugs are different; however, if the data miss on efficacy, this is a problem for SRPT because the exon skipping mechanism of action of both drugs is basically the same. Either the modified dystrophin that both Drisaprsen and Eteplirsen produce works to improve outcomes, or it doesn't. On this point bulls can't have it both ways. If SRPT should be allowed to file for accelerated approval due to dystrophin being a proper surrogate biomarker, then the drisapresen data have read through for eteplirsen as far as efficacy goes.

Ultimately the current ATM facility increases the outstanding share count by 10%. We believe that SRPT is likely to use the ATM facility sooner rather than later. If the company were 100% confident that the FDA were going to give the green light for filing for accelerated approval, then why not wait an do a proper secondary that puts the stock in the hands of institutional investors that will back the company strongly? One possible explanation is that a secondary now, close to a potentially binary decision for the stock, was not a viable option for SRPT. We have no position in SRPT.

Coranado Biosciences (NASDAQ:CNDO)

Here's what we told our beta testers regaridng CNDO on Monday:

Quick Take:

Coranado (NASDAQ:CNDO) announced completion of enrollment in their phase 2 trial of CNDO-201 for treatment of chron's disease. Top line results expected Q4 2013

Details

Coranado's phase 2 trial just completed enrollment. The stock has been already running this year from a January low of around $4.50 to as high as $12 before drifting back down to it's current price of $8.60. The stock just bounced off the 200 day exponential moving average late last week. The overhead resistance is the 20 day EMA at $8.64.

CNDO-201 is purified Trichuris suis ova (pig worm eggs or hemlinths).

There is some evidence of an inverse correlation between the geographies where hemlinths are endemic to the population and the prevalence of chron's disease. We have no view on the likelihood of success of the present trail at this time but CNDO is a stock we will be looking at a bit later this year.

There's always a bit of an 'ick' factor when considering the origin of the medicine as well as the idea that a medical therapy consists of purposefully exposing someone to live parasites; however, for sufferers of Chron's a truly effective therapy, as long as it is safe, is badly needed. We have no position in CNDO.

Threshold Pharmaceuticals (NASDAQ:THLD)

Once again, from our missives to beta testers here was our take on THLD on Monday morning:

Quick Take:

$THLD has eliminated an interim look at the secondary endpoint of PFS for their Phase 3 trial of TH-302 in soft tissue sarcoma (STS) and increased the enrollment from 450 to 620 citing new assumptions of the performance of standard of care (doxorubicin). This is Generally Bearish for the study in our view.

DetailsRecall that Ziopharm (ZIOP) reported a trial failure in STS back in March because the doxorubicin arm had longer than expected PFS.

THLD has an SPA with FDA and their trial endpoint is overall survival. As the press release indicates, the increase in enrollment is " to strengthen the ability of the study to detect a clinically meaningful and statistically significant effect of TH-302 on overall survival."

Eliminating the interim look at the PFS data enables the company to preserve that study power for the overall survival endpoint. This means that the company recognizes that the newer survival data for STS with doxorubicin affects their modeling for the phase 3 study. This effectively moves THLD's catalyst to 2015 (there was supposed to be an interim PFS look this month).

While the IDMC will look at the Overall survival when 235 events are reached, and there is a possibility to end the trial early for efficacy, in our last conversation with THLD's CEO, he acknowledged that the early termination OS margin was a stretch goal. Today's developments indicate, in our view, that the study will NOT terminate early for efficacy.

We reached out to THLD's IR department to ask some clarifying questions since we were busy on another conference call that mooring and did not catch the prepared remarks. We confirmed with IR that, previously, the company's modeling for the trial assumed a 10 month median overall survival for the doxorubicin arm, and the new modeling assumption is 12 months median OS. Second, we confirmed that THLD partner Merck will pay for 70% of the costs of the additional patients in accordance with the company's partnership deal. In order to stop the trial early for efficacy next year, the independent data monitoring committee (IDMC) would need to see p < 0.0023 for the treatment difference in OS. This is clearly a stretch goal that in our view is unlikely to be met given the company's decision to increase trial size. We also confirmed that the IDMC never did the interim PFS analysis at all. in other words, there is no loss of statistical power from the current trial population. Finally, the change in patient count does modestly affect cash guidance and THLD will be updating on this during their upcoming Q2 2013 conference call.

The market did not seem to react to the THLD news at all. The stock opened the week at $5.32 and closed on Friday at $5.43. Our view is that this news has not been properly factored in to THLD's stock price. removing a near-term catalyst and increasing trial sizes are negative indicators for trial success in our opinion. After the Q2 conference call, as more analysts figure out that the study assumptions changing makes it ore difficult for TH-302 to hit the agreed upon 40% improvement in overall survival (recall THLD has a special protocol assessment or SPA agreement with FDA), there may be some downward revisions of price targets for THLD leading to downside to about $4 in the stock. We have no position in THLD.

Insmed Inc. (NASDAQ:INSM)

We alerted our beta testers to some mispricing in INSM on Monday morning:

Insmed announced positive top-line results in it's sutdy of ARIKACE for treatment of Pseudomonas aeruginosa (Pa) in cystic fibrosis (CF) patients.

The study's primary endpoint was non-inferiority compared with twice-daily TOBI®* (tobramycin inhalation solution) for relative change in forced expiratory volume in one second (FEV1), measured at the end of the third treatment cycle (24 weeks) as compared to baseline. What's unclear is exactly what the non-inferiority margin is. Slides for the 8 am conference call show that ARIKACE is numerically inferior to TOBI.

INSMED shares tumbled from $11.96 Friday to a premarket low of $8 as of this writing and just before the conference call.

There may be a slight bounce in INSMED today after the call. The drug received Qualified Infectious Disease Product and Fast Track Designations from the U.S. FDA for the Treatment of Non-Tuberculous Mycobacteria Lung Infections. The NTM study is still underway and will likely report results later in the year.

Indeed, INSM went on to recover to as high as $10.50 on Monday and closed the week at $10.34. We did not take a position in INSM during the bounce because it is not a name we had done enough work upon. While a quick 25% gain is always nice, we only make such trades on names where we have an understanding of the fundamental story. Perhaps this causes us to miss some potential gains, but it also frees us from being glued to our trading screens all day.

Achillion Pharmaceuticals (NASDAQ:ACHN)

Achillion hit a snag this week when the FDA put a partial clinical hold on their trials due to drug-drug interactions seen between sovaprevir with ritonavir-boosted atazanavir in a phase 1 drug-drug Interaction (DDI) study in healthy subjects. Several patients had elevated liver enzymes indicative of hepatoxicity when they took both drugs together. sovaprevir is being developed to treat Hepatitis C (HCV) and the DDI study addresses the subset of HCV patients who also have HIV and take ataznivir for treatment.

Sovaprevir is an NS3 protease inhibitor. Ataznivir is also a protease inhibitor targeted at HIV. Ataznivir is known to interact with some other protease inhibitors that are metabolized by cytochrome P450 3A4 (CYP3A4). Johnson & Johnson saw similar reactions when testing their HCV compound with Ataznivir, and Bristol Myers Squibb (BMY) has not tested their HCV compound with Azatnivir and has no plans to do so. In BMY's case this is somewhat ironic since azatnivir is their drug.

Sovaprevir has been tested for DDIs with a wider number of compounds and until now has had a relatively clean profile. In practical terms, HCV patients co-infected with HIV represent approximately 9% of HCV patients are co-infected with HIV. While this is an important subset, not all HIV co-infected patients will be on ataznivir since there are other choices for anti-retroviral therapy. Thus the true impact on marekt potential from this DDI is about 1% - 2% of the addressable market.

When news of the clinical hold came out, ACHN stock dropped by 25%. Our view is that this was an over reaction. Importantly, while the FDA has put the initial new drug application (IND) for sovaprevir on clinical hold, this does NOT affect the ongoing phase 2 study of sovaprevir in combination with Achillion's ACHN-3102. The phase 2 combination study (study 007) is being conducted under the IND for ACHN-3102 and FDA has allowed enrollment and dosing to continue in that study.

Timelines are now critical for ACHN. In their press release disclosing the clinical hold (linked above), the company indicated that they will be responding the FDA's data request within six weeks. Also, the company reported that patients in the 007 study have received "up to 6 weeks of combination treatment". The first data point to come from this trial will be the rapid virologic response data (after 4 weeks of treatment) due in Q3 2013. Sustained virologic response at 4 weeks (SVR4) data will be out in Q4. IF the clinical hold is lifted before the SVR4 data come out, then the stock should easily recover from the 25% haircut ahead of the data. However, if the hold is not yet lifted, the data itself may play a more important role. If the trial shows less than expected efficacy of the interferon-free regimen, then the lifting of the hold is a moot point as the prospects of the sovaprevir + ACH-3102 + ribavarib regimen will be in question. Should the data be positive, but the hold still be in place, the hold may act as a slight overhang to the stock despite positive data.

Our view is that the DDI with ataznivir is not a major issue for ACHN. While the company and FDA will pursue the issue with diligence, we believe that the hold is likely to be lifted expeditiously since the likely mechanism for the hepatoxicity is fairly well understood. We have no position in ACHN but this special situation has put the stock on our watch list.

Vivus Pharmaceutical (NASDAQ:VVUS)

This week saw the next stage in the VVUS proxy saga. On Monday, the company announced the availability of Qsymia in 8,000 retail pharmacies. This retail rollout comes a bit earlier than expected. VVUS originally planned to be in thousands of retail pharmacies by mid-July. Our view is that the company moved up the timeline so that they could tell shareholders "see we're doing things ahead of schedule" which is exactly what VVUS management did in a letter to sharholders on July 2nd. On Friday, both VVUS and First Manhattan Co (FMC), the lead investor behind the alternate board for VVUS, issued conflicting press releases regarding the opinions expressed by proxy advisory firms. VVUS claimed that "2 leading proxy advisory firms reject FMC's attempt to take controll of the Vivus board". Meanwhile, FMC claimed that "ISS and Egan Jones recommend that Vivus Stockholders Vote For First Manhattan's Nominees for Election to Vivius Board". As with both sides' claims about their previous track records, each claim is partly true. ISS recommended 3 of FMC 9 nominees, while Egan Jones recommended the entire FMC slate; however a third proxy advisory firm, Glass Lewis backed none of FMC's nominees. Even for Glass Lewis, FMC focused on the fact that the firm called the plan to launch Qsymia alone "ill advised".

Last week we mentioned looking at the July at-the-money options straddle (buying both a call option and a put option at the price closest to the current stock price). The premiums for the at-the-money ($12) options straddle is around $1.30. We believe that VVUS stock should move more than $1.30 in the event that FMC is successful in their bid to take control of VVUS. What is less clear is what happens in the event that the current board retains complete control (we expect FMC and Sarissa capital to eventually liquidate their positions but not immediately), and especially, what happens in the case of a split board. If some, but not all of FMC's nominees gain board seats, they will have some influence, but likely not enough to drastically alter the course of the company.

We have no position in VVUS.

Add new comment